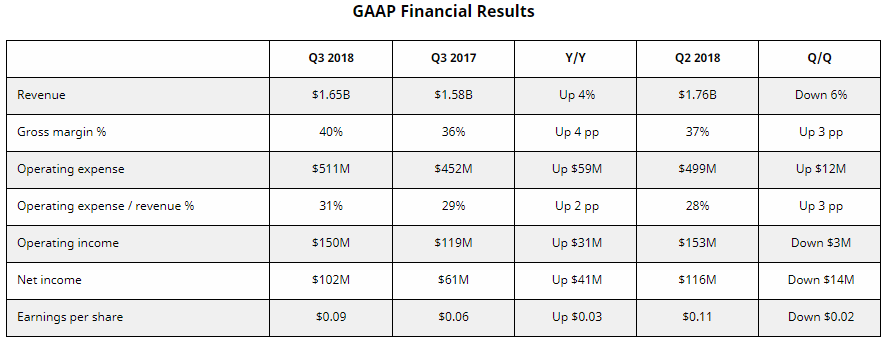

This evening AMD announced their Q3 2018 results. Things were at the lower end of the guidance scale from last quarter, but the company still had some solid results. Q3 revenue was $1.65B as compared to Q3 2017’s $1.58B. It is down from the previous quarter’s high of $1.76B. At first glance this seems troubling, but the results are not as negative as one would assume. GAAP net income was a healthy $102M. Q3 2017 was at $61M while Q2 2018 was up at $116M. Profits did not fall nearly as much as one would expect with a decrease of $110M revenue quarter over quarter.

Probably the largest factor of the decrease was the negligible sales of GPUs to the crypto market. AMD had expected such a dropoff and warned about it in their Q2 guidance. That particular drop off was sudden and dramatic. AMD looks to continue to lose marketshare in add-in graphics due to their less competitive offerings across the spectrum. GeForce RTX sales of course did not impact AMD this previous quarter, but with no new AMD offerings on the horizon users look to have been waiting to see exactly what NVIDIA would release.

Ryzen sales have been steady and strong, making up some of the shortfall from the graphics market. Desktop chips are moving briskly for the company and continues to be a strong seller historically for the company. AMD is also starting to move more mobile processors, but it seems that the majority of parts are still desktop based. AMD looks to continue moving older inventory with aggressive pricing on those and manufacturing of the new 2000 series parts has been relatively smooth sailing for the company.

Enterprise, Embedded, and Semi-Custom had a strong quarter, but with less growth as some analysts had been hoping for. Semi-Custom was weaker this quarter, but IP revenue is up. Console chips are weaker at the moment due to the platforms being relatively mature and not exhibiting the sales of the previous two holiday seasons. To further offset the decrease in Semi-Custom, AMD is reporting that the enterprise products (GPU and EPYC) have seen good growth. Overall this division was down 5% from Q3 2017, but up 7% from the previous quarter.

Perhaps the most interesting figure of this is Gross Margins. AMD was able to improve margins from 36% to 40%. This 4% increase quarter on quarter is a significant jump for the company. This means that AMD continues to keep costs under control for the company and is able to deliver product more efficiently than in the year before. It is still a far cry from Intel and NVIDIA, which typically have magins between 55% to 65%. AMD has a long ways to go before reaching that kind of level. Part of the margin offset was again due to IP licensing. If IP licensing was removed then we would see 38% margins rather than 40%.

So what are the overall lessons of the past quarter? EPYC sales are not as brisk as analysts had hoped for, but they are also not non-existent. It has shown solid growth for the company and has offset shortfalls in other areas of the company. Their IP and Semi-Custom areas are still very solid, even though AMD does suffer from console lifecycles and downturns. GPUs continue to sell, but not nearly at the rate they were due to the crypto market. Their Polaris based options are well suited to compete in the sub-$300 US market. The Vega based products were finally down to MSRP, but they had a harder time going against the mature and well liked GeForce GTX 1070 and 1080 products. This will be further compounded with the introduction of the RTX products in those price ranges.

Ryzen continues to be a very good seller across the board. I had hoped that AMD would break down numbers between Ryzen CPUs and APUs, but I have not seen numbers that hint at what ratio they sell at. In retail the Ryzen 2000 series CPUs look to be some of the most popular products based on price/performance. However, retail is only a small portion of processor sales and Intel still holds the vast majority of marketshare here. AMD is competing, but they have not taken significant chunks from their competition over the past year. They have done enough to achieve several positive quarters in a row, but this is not the slam dunk that the original Athlon 64 was back in 2003/2004.

AMD expects further weakness in their results next quarter. Guidance is for revenue around $1.45B, plus or minus $50M. This is still higher than Q4 2017 results, but it is a significant drop from Q3 results. AMD expects strong Ryzen, EPYC, and datacenter GPU growth during this time. It is expected that consumer GPU and Semi-Custom will continue to drop. There does look to be a 7nm GPU introduction this next quarter, but it is probably the long rumored Vega refresh that will be aimed directly at datacenter rather than consumer.

2018 has so far been a year of solid growth and execution for AMD on the CPU side. Their GPU side has suffered a bit of a slide, but this is to be expected by how much belt-tightening AMD has done in the past several years to get their CPU architecture back on track. The lion’s share of development resources was shunted off to the CPU side while the GPU side had to fight for scraps. I believe this is no longer the case, but when development takes years for new GPUs the injection of new resources will not become apparent for a while.

2019 continues to look better for AMD as they are expecting an early release of 7nm EPYC parts which should compete very well with Intel’s 14nm based Xeon products. AMD is expecting a significant uptick in sales due to the thermals, pricing, and performance of these new Zen 2 based parts. The company also continues to point to the end of 1H for introduction of 7nm Ryzen parts based on Zen 2. These will be showing up quite a few months before Intel’s 10nm offerings will be available. Rumors have it that the new Zen 2 based parts exhibit a significant IPC increase that should make them far more competitive to the best that Intel has on the desktop and mobile markets. Combine these IPC improvements with the 7nm boost in power and clocks for the parts, and AMD could have a very good product on their hands. AMD also is expecting a 1H release of 7nm Navi GPUs which should prove to be more competitive with current NVIDIA products that rely on 16nm and 12nm process nodes from TSMC.

While Q3 was a drop in revenue for the company, their current cost structure has still allowed them to make a tidy profit. The company continues to move forward with new products and new developments.

Nice work Josh!

Nice work Josh!

“AMD is reporting that the

“AMD is reporting that the enterprise products (GPU and EPYC) have seen good growth”

This is the what will continue to be the main area of growth for AMD with its Epyc and Radeon Pro WX/Instinct server/HPC/AI portfolio of enterprie CPU and GPU products.

AMD will only need over the next 4 to 6 Business Quarters to continue to show Epyc and Professional GPU revenue increases and that’s directly what has increased AMD’s Gross Margins to 40% this quarter up 3% from Q2 2018. It will take a good while longer but AMD should see Epyc/Pro Compute/AI GPU sales markups/margins increasing and becoming a large enough source of overall revenues to make any consumer GPU revenue fluxuations less of an issue.

AMD’s stock volatility issues has made AMD a target of the speculators and as soon as AMD can grow its Epyc/Pro GPU market revenues and market share enough any consumer/coin mining or gaming revenue swings will impact AMD’s share price stability to a much lesser degree. AMD’s growth fundamentals are still good and it’s just that lately in the background of an overall Chip market share prices decline that’s affecting the entire market for processor makers that AMD’s share value declines look worse than normal. And the tariffs are not helping the PC market with higher tariffs to come in Jan 2016.

AMD’s enterprise embedded and semi-custom(EESC) accounting unit would have better results if the console sales figures declines where factored out and a better pitcure of just the Epyc/Pro GPU sales could be estimated. And it’s really the Epyc/Pro GPU sales that have kept the EESC business unit’s figures from declining fruther.

“While Q3 was a drop in revenue for the company, their current cost structure has still allowed them to make a tidy profit. The company continues to move forward with new products and new developments”

AMD is such a lean business operation that they have been able to turn a profit on Gross Margin of only 36% and Intel has gross margins in the low 60s%. But Intel is such a high overhead operation(Chip Fabs and Middle Management heavy) that if Intel’s gross margins dropped below 55% Intel would have to begin the painful cutting process in order to fruther reduce Intel’s very high business overhead. AMD is still primed to grow and be able to show some profits along the way to higher Gross Margins and revenue stability as Epyc/Pro GPU sales as AMD’s enterprise market share continues to grow larger.

With each Server Market share precentage point growth for AMD in a market that’s seeing rapid growth in its TAM size that’s been on the rapid increase(1) lately over the last 18 months, AMD can increase its quarterly gross revenues by the 100s of millions of dollars. So those single into double digit server market share figures via continued server market share increases can become a very large share of AMD’s most stable quarterly revenue growth figures and some very stable recurring revenues quarter to quarter also for more overall stability in share price valuation for AMD.

(1)

“The Server Market Booms, And It Could Last For A While”

https://www.nextplatform.com/2018/03/01/server-market-booms-last/

Still waiting for a sub-$400

Still waiting for a sub-$400 GPU bearing the Vega name that outperforms a GTX 970 enough to make it worth upgrading.