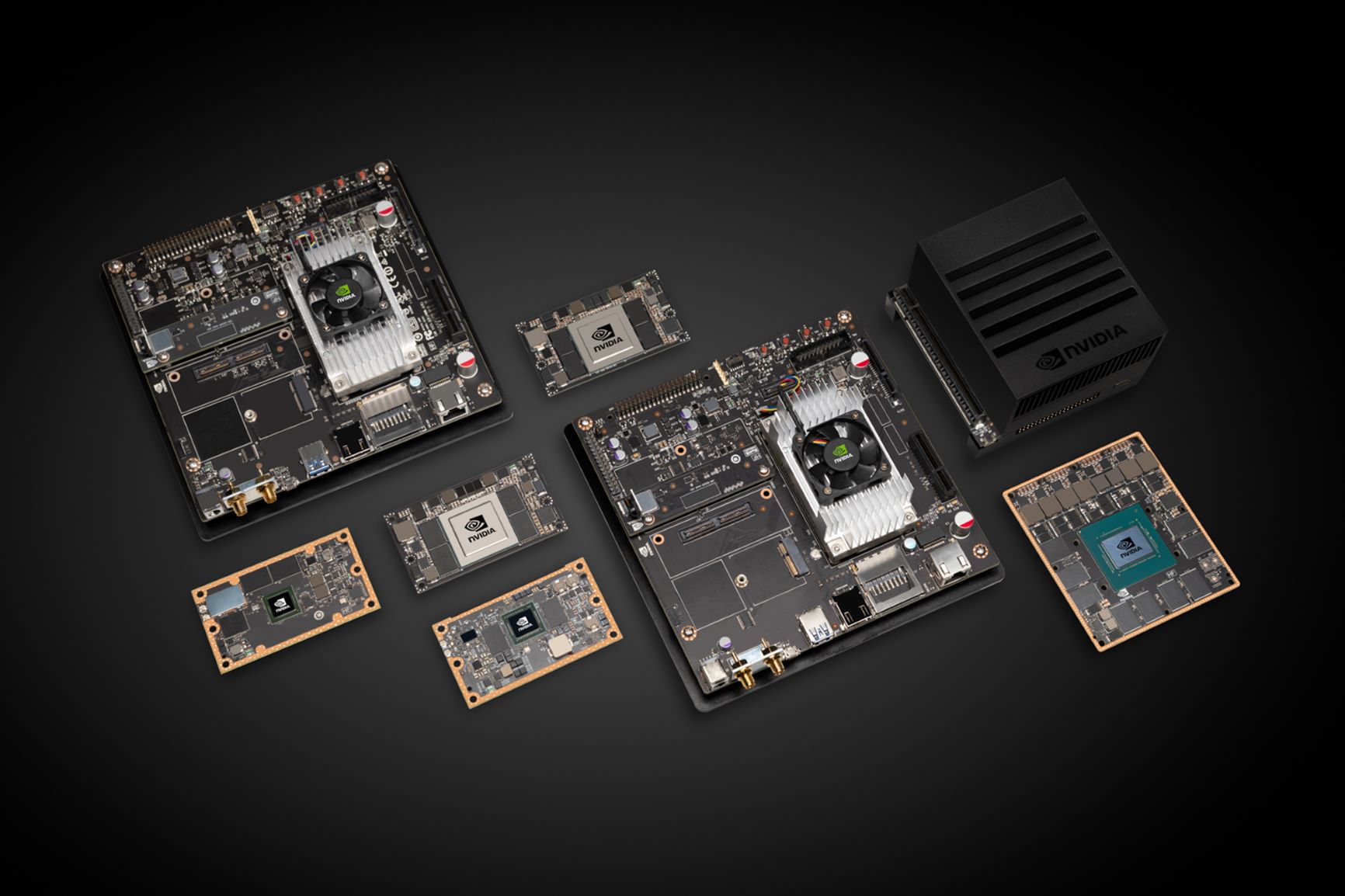

NVIDIA claims their newly announced Jetson AGX Xavier SoC can provide up to 32 trillion operations per second for specific tasks, requiring a mere 10W to do so. The chips are design for image processing and recognition along with all those other 'puter learnin' things you would expect and chances are a device will have several of these chips working in tandem, which offers a lot of processing power. It is already being used for real time monitoring of DNA sequencing and will be installed in car manufacturing lines in Japan.

The Inquirer points out that this performance comes at a cost, currently $1100 per unit as long as you are buying 1000 of them or more.

"Essentially a data wrangling server plonked onto a silicon package, Jetson AGX Xavier is designed to handle all the tech and processing that autonomous things need to go about their robot lives, such as image processing and computer vision and the inference of deep learning algorithms."

Here is some more Tech News from around the web:

- RISC-V Will Stop Hackers Dead From Getting Into Your Computer @ Hackaday

- Small American town rejects Comcast – while ISP reps take issue with your El Reg vultures @ The Register

- In a Test, 3D Model of a Head Was Able To Fool Facial Recognition System of Several Popular Android Smartphones @ Slashdot

- Russia's cutting edge robot turns out to be bloke in costume @ The Inquirer

- Asustek president Jerry Shen to leave in major business revamp @ DigiTimes

- Julius Lilienfeld and the First Transistor @ Hackaday

- Ticketmaster tells customer it's not at fault for site's Magecart malware pwnage @ The Register

- The Worst CPU & GPU Purchases of 2018 @ Techspot

- Hands-on: Switch’s NES controllers offer unmatched old-school authenticity @ Ars Technica

- Standing Desk Starter Guide: Some Dos and Don'ts @ Techspot

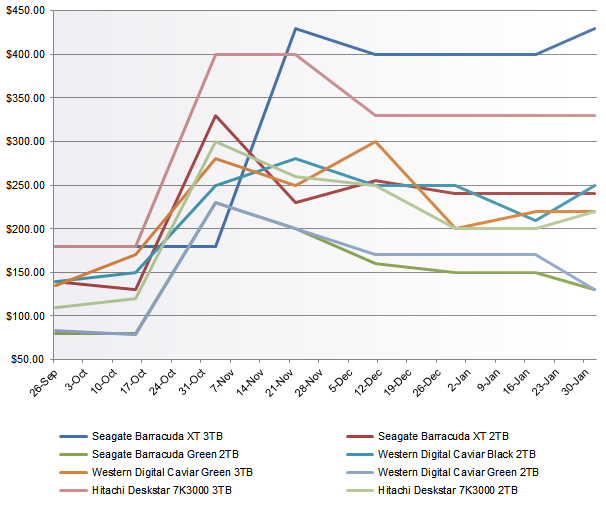

Jane stop this crazy stock

Jane stop this crazy stock price falling thing!

Nvidia is more extended into the GPU market than AMD, and by extended I mean that Nvidia has a larger share of the GPU market and Nvidia’s CEO should have learned from AMD’s coin mining market mistakes of the past and never increased production on the “promise” of coin mining market stability.

Nvidia’s share price has fallen by almost half since its Oct 2018 high point and AMD has not as much GPU market share to worry about in addition to AMD’s x86 market that looks to be taking greater hold over the next several business quarters. AMD spends less per core on its Epyc SKUs and gets a higher per core markup per CPU core than can be had by any GPU with thousands of cores.

AMD’s Epyc/Rome Chiplets will be even smaller and those Die/Wafer yields will allow AMD to make mint from each CPU Chiplet that goes into any Epyc SKU. The First generation Zen/Zeppelin Die although not as small is still tiny relative to any Discrete GPU die. AMD will begin to see more profits that are CPU Die related than Nvidia has that are GPU Die related, in addition to any GPU related business that AMD can get/maintain. AMD’s best bet is with Vega 20 and the Professional Compute/AI market where at least the markups are greater than consumer/gaming GPUs.

The Coin Mining market is too crazy to target and AMD was more careful about it’s production this time around so AMD did not become excess inventory burdened when the bottom fell out of coin prices.

Nvidia’s Turing GPU’s ASP/MSRP is so high that with Navi AMD can target a hgher price point and still undercut Nvidia’s pricing by a good margin and get more revenues and maybe even a larger share of the mainstream Discrete GPU market. No one appears to be trying to suss out AMD’s share of the Integrated Graphics market even though AMD’s Raven Ridge Desktop GPUs have been on the market for a good while now. AMD has an uphill battle in the Laptop market and the mini desktop form factor market but still AMD’s Raven Ridge has to have some integratd market share figures to be looked at that’s defnitely larger than any non Zen/Vega based APUs of the past. Zen-2 based APUs, once they become available on 7nm, should allow AMD some chance to gain even more integrated graphics market share.

Nvidia is definitely in for some rough investor waters if it can not stabilize its excess inventory of Pascal Parts moving towards the lowest resonable amounts of previous generation products that normally stick around for any GPU maker.

Even the costs of this AGX Xavier SoC development kit is relatively high and this and Turing’s higher MSRP may cause some market share numbers to shift over to AMD’s side. Nvidia’s RTX feature sets are still going to take time for games developers to adopt in a more wide spread fashon so many AMD will have time to at least get some dedicated Tensor Core IP into some future GPU designs. Vega 20 will come with a larger set of AI instruction extentions for the Professional AI market and AI based upscaling is probably something the semi-custom console clients are seriously looking at for their future console products.